By Lesley Weidenbener

TheStatehouseFile.com

INDIANAPOLIS – Gov. Mike Pence’s plan to eliminate the tax on business equipment would mean significantly higher taxes for other property owners if the state took no specific action to protect them, according to a new analysis.

The proposal would also mean big losses for local governments – unless another tax was created or increased to make up for the revenue.

And to do so with the individual income tax would mean a statewide average increase of more than three-quarters of a percent, according to the report from the nonpartisan Legislative Services Agency.

That could mean an additional $577 a year for a family with taxable income of $75,000. And for residents of the state’s more manufacturing-heavy counties, the amount would be substantially higher – as much as three times more.

Interactive map

Click the map below to see how large of an income tax increase would be needed in each county to replace the personal property tax.

“It all depends on the mix of the properties you have that you’re able to tax,†said David Bottorff, executive director of the Association of Indiana Counties.

“Ironically, it’s the communities that in general have been the economic hubs that are hurt the most – Howard County, Spencer, Gibson, Lake – the counties that have a lot of job creation and they rely on the personal property tax to help hold down everybody’s taxes,†Bottorff said. If the personal property tax is eliminated, “those are the ones that pick up the biggest shifts and the losses. It’s really a statewide issue but those are the communities that have the most to lose.â€

The personal property tax is imposed on equipment used by businesses. Personal property can be a photographer’s camera or an automaker’s metal stamping machine or a newspaper’s printing press and it makes up about 14.5 percent of the state’s taxable property value.

Currently, the tax generates nearly $1.1 billion for cities, counties, schools, libraries and other local governments, according to the Legislative Services Agency report.

But Pence says it’s an impediment to business development and so he wants to dump it, a proposal that’s been backed for years by the Indiana Chamber of Commerce.

The tax “discourages companies from investing in new technology and the expansion of their businesses,†Pence said in a speech this month. “As the most manufacturing-intensive state in the nation, we are holding back new capital investment because of our business personal property tax.â€

However, Pence has not said how – or if – he will back replacement revenue for local governments. He says he’ll leave that decision to the General Assembly.

And his office had no comment on the new report. His press secretary, Kara Brooks, said, “Our policy team has not seen the report yet and this is the first I’ve seen of it as well.â€

The report, which was released Monday, provides a peek into some of the options, although it advocates no position.

The report found that:

Eliminating the personal property tax without other changes would shift costs to other property owners.

That’s because local governments establish levies – which represent the total they aim to collect – and then that amount is split among taxpayers. If one group – such as those that own business equipment – is eliminated, then others pay more.

LSA estimates the shift in this case could mean the owners of so-called real property – which includes homes, buildings and land – would pay about $375 million more annually. Homeowners would be the largest single class of property owners to pay more.

The total shift would be higher but the state has limited property tax bills. So as tax bills increase, more property owners would hit the cap, reducing revenue to local governments.

Replacing revenue with income taxes would mean significantly higher rates in some counties.

Pence has not advocated any way to replace revenue lost if the personal property tax is eliminated, but in similar situations, policy makers have turned to the local income tax as a makeup option.

The LSA report finds that to fully replace the lost revenue, counties would need to boost their income tax rates by an average of 0.77 percentage points – but the amount varies widely.

In Brown County, it would take an income tax increase of just .10 percentage points (about $75 a year for a family with income of $75,000) compared to a 2.78 percentage point increase in Spencer County (an increase of $2,085 for the same family).

The combination of tax caps and the elimination of the personal property tax means local government would lose about $554 million annually.

Without other changes or replacement revenue, cities and towns would be hit hardest by the elimination of the personal property tax, with about $175 million in total losses, according to the report.

Schools would also be big losers – about $151 million.

Additionally, tax increment finance districts – often calls TIFs – would lose significant revenue. Those districts are set up to capture tax revenue to use for special projects, usually to pay off bonds associated with construction or infrastructure improvements.

Pence has said repeatedly that he doesn’t want to “unduly†burden local governments. And he’s proposed a phase-out of the tax so the impact doesn’t hit at once.

“We will work to empower communities and local governments in this process,†Pence said. “Time and economic growth should be our friends here, making it possible to phase out the tax while protecting local governments.â€

But key fiscal leaders – including Senate Appropriations Chairman Luke Kenley, R-Noblesville – have said there are significant issues lawmakers must tackle. Among them is how to make up the revenue – and who should do so.

Kenley said a key decision is whether businesses that are benefitting from the elimination of the personal property tax should be the ones who pay, rather than shifting the burden to individuals.

That could require creating a new tax, something the LSA report doesn’t address.

Lesley Weidenbener is executive editor of TheStatehouseFile.com, a news website powered by Franklin College journalism students.

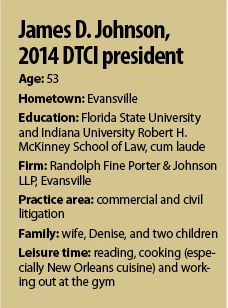

Johnson

Johnson Johnson shied away from calling the committee’s efforts a success but he did note that many times the courts would rule in favor of the position DTCI had advocated.

Johnson shied away from calling the committee’s efforts a success but he did note that many times the courts would rule in favor of the position DTCI had advocated.

Abbey Court Apartments in Evansville partnered with the St. Mary’s Medical Center Foundation and the St. Mary’s Center for Children to help brighten the spirits of local children this holiday season.

Abbey Court Apartments in Evansville partnered with the St. Mary’s Medical Center Foundation and the St. Mary’s Center for Children to help brighten the spirits of local children this holiday season.