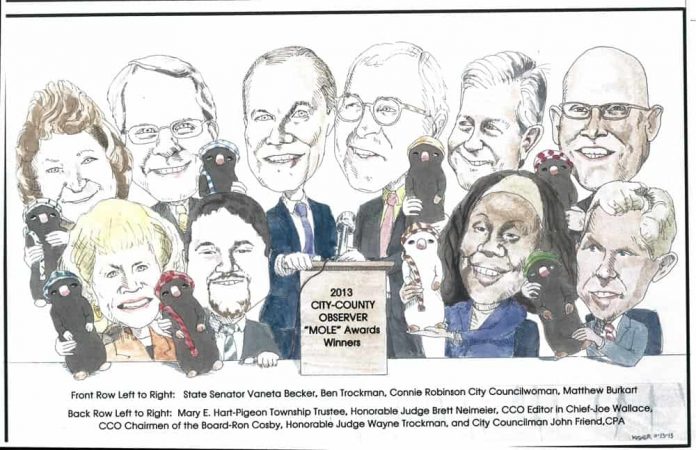

2013 Mole Award Door Prize Winnersâ€

Will Government Shutdown lead to Food Riots?

Food stamps, unemployment benefits and social security payments could be delayed for days if the US suffers a debt default, an alarming prospect given that an EBT card outage which lasted for just hours on Saturday caused mini-riots and looting at several Walmart stores.

Should the US enter a post-debt ceiling economy on Friday, “payments to Medicare and Medicaid providers, unemployment benefits, Social Security checks and tax refunds would be postponed for one to four days,†reports the Washington Post, citing a Bipartisan Policy Center report.

This means that food stamps set to be distributed on October 25 would be delayed until at least October 30, and nearly $60 billion in Social Security checks could be delayed by two weeks.

Judging by the reaction to Saturday’s EBT card glitch, which prompted “mini-riots†and looting after just hours, a food stamp freeze lasting for days would threaten even more widespread unrest.

Food stamp-style debit cards stopped functioning on Saturday after a routine check by vendor Xerox Corp. resulted in a system failure. Although the problem was fixed by the evening, the temporary outage caused a “mini-riot†at a Walmart in Philadelphia, Mississippi, prompting managers to close the store.

Walmart spokeswoman Kayla Whaling said the financial impact of the “mini-riot†was still being assessed and that the company was working with police to identify the culprits. Customers staged the disturbance before walking out “with groceries that hadn’t been paid for,†reports the Clarion Ledger.

EBT card holders in Louisiana also ransacked local Walmart stores in an attempt to exploit temporarily unlimited credit balances.

“Shelves in Walmart stores in Springhill and Mansfield, LA were reportedly cleared Saturday night, when the stores allowed purchases on EBT cards even though they were not showing limits,†reports KSLA. “The chaos that followed ultimately required intervention from local police, and left behind numerous carts filled to overflowing, apparently abandoned when the glitch-spurred shopping frenzy ended.â€

One woman attempted to steal $700 dollars worth of groceries despite the fact that she had a balance of just $0.49 on her EBT card.

“As this small EBT card glitch clearly demonstrates, if given half a chance, many EBT card holders will immediately engage in the mass looting of food and supplies as long as they can get away with it,†writes Mike Adams. “This was not one or two isolated people; this involved masses of people who spontaneously transformed into a rampaging mob of looting maniacs that ransacked a private business and caused huge losses in stolen goods and displaced inventory.â€

If a relatively minor EBT card glitch that lasted just hours caused looting and “mini-riots†at several Walmart stores, what will the consequences be of a five day hold on food stamps?

If lawmakers and the White House fail to strike a deal that will temporarily raise the debt ceiling before the end of this week, we’re about to find out.

Source: InfoWars

IS IT TRUE October 15, 2013

IS IT TRUE October 15, 2013

IS IT TRUE that the Evansville City Council showed a sense of practicality last night in discouraging Mayor Winnecke’s office from moving forward to spend $1.5 Million on work at Roberts Park during last night’s meeting?…all of the members of the Council present voiced support for a park at that location but all of them seem to understand that the Evansville Parks system is already incapable of being properly maintained and sustained with the maintenance team and budget that is in place?…a cursory drive around the City of Evansville confirms that the parks are just not up to snuff when it comes to basic maintenance work being up to acceptable standards?…Evansville does have a well designed park system that was laid out for a growing and prosperous population back in history at a time when this was true?…in spite of recent claims the population is still stagnant, the budget is at the mercy of outside forces like Riverboat revenue and property valuations, and the City is going to need to consider maxing its debt limit to provide incentives to the IU Medical School?…this is not the time to be spending money on Roberts Park?…this can be revisited at the end of 2014 when both the IU Medical School and the Riverboat revenue issues will be understood?

IS IT TRUE the view of the old Roberts Stadium lot from the Lloyd Expressway is actually quite nice as an open field?…it does not look like something needs to be there with any urgency?…there is one issue that needs to be addressed other than money before a park is put there and that issue is road noise?…just to the ear the magnitude of the road noise gets pretty offensive as one gets within 100 paces or so from the Lloyd?…unless a sound barrier is put into place this particular location may not be something that families, joggers, or walkers would choose?

IS IT TRUE it was also revealed last night that that the Indiana State Board of Accountancy has not yet released the annual audit and that there is still not agreement on the reconciliation of the City of Evansville’s financial records?…the City still has Umbaugh and Associates under contract to deal with reconciliation?…that being the case the assertions from Controller Russ Lloyd Jr. that the books are balanced is still legitimately in question?…with financial consultant David Garrett and Mr. Lloyd still in disagreement, Umbaugh still on the job, and the SBOA taking so long to release the audit, this is no time to be committing to spending a blasted dime in the fair and unbalanced City of Evansville?

IS IT TRUE that California’s Coachella Valley (greater Palm Springs) has 129 hotels from the Ritz Carleton to the Days Inn, 116 golf courses, a water park, a sky tram, and countless other tourist attractions and parks?…in spite of this multitude of fun and games things the top priority of all nine of the cities is to develop a sustainable job base so the best and brightest people will stay?…with over $10 Billion in fun, games, and tourism objects in place with fully operational state of the art infrastructure, and even civic pride that shows no squalor the BASIC NEED FOR GOOD JOBS is still not filled?…those in Evansville who think one hotel will even put a dent in infrastructure and jobs issues are tilting at windmills?…if $10 Billion won’t solve such a problem $44 Million is not even a band aid?…it is time for Evansville to focus on what it needs as opposed to the distractions that Pinocchio would have found at Pleasure Island where he was slated to be turned into a jackass?

SCORE Evansville Indiana

|

BMV Commissioner To Resign In December

R. Scott Waddell, commissioner of the Indiana Bureau of Motor Vehicles (BMV), will be stepping down effective the beginning of December.

R. Scott Waddell, commissioner of the Indiana Bureau of Motor Vehicles (BMV), will be stepping down effective the beginning of December.

“I am honored to have served Governors Mitch Daniels and Mike Pence as commissioner of the BMV. Just as important, it has been my privilege to play a role in the ‘Best in the Country’ successes achieved by the dedicated and hard-working associates of the Indiana BMV,†Waddell said. “The accomplishments of our customer oriented agency have raised the bar for bureaus throughout North America.â€

During his tenure at the BMV initiatives such as branch visit time monitoring technology, touch-screen computers for knowledge testing and transaction-based smart phone apps were implemented.

Waddell’s last day will be Dec. 2.

Harrison High School to Host Open House

Although it seems like school has just started, schools in the EVSC already are preparing for next school year. To give students and families more information about the school, Harrison High School is hosting an Open House for current eighth grade students and their parents on Monday, October 21, at 6 p.m. in the Shoulders Family Commons at Harrison High School. Harrison High School officials will be on hand to talk with families about enrollment, programs/classes offered, tips for starting high school and answer any questions.

Vanderburgh County Felonies

Below is a list of felony cases that were filed by the Vanderburgh County Prosecutor’s Office on Friday, October 11, 2013.

Below is a list of felony cases that were filed by the Vanderburgh County Prosecutor’s Office on Friday, October 11, 2013.

Scott Cobb                         Theft-Class D Felony

Thomas Cruse                  Operating a Vehicle as an Habitual Traffic Violator-Class D Felony

Alvin Love                          Operating a Motor Vehicle after Forfeiture of License for Life-

Class C Felony

Leah Maurer                     Burglary-Class B Felony

Ashley Weir                      Neglect of a Dependent-Class D Felonies (Two Counts)

Adjani Dowell                  Operating a Motor Vehicle after Forfeiture of License for Life-

Class C Felony

Shay Easley                       Intimidation-Class C Felony

Ronny James                    Theft-Class D Felony

(Habitual Offender Enhancement)

Kevin Meier                      Possession of Methamphetamine-Class D Felony

Possession of Marijuana-Class A Misdemeanor

(Enhanced to D Felony Due to Prior Convictions)

Possession of Paraphernalia-Class A Misdemeanor         Â

For further information on the cases listed above, or any pending case, please contact Kyle Phernetton at 812.435.5688 or via e-mail at KPhernetton@vanderburghgov.org

Under Indiana law, all criminal defendants are considered to be innocent until proven guilty by a court of law.