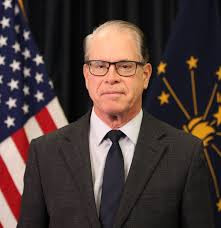

PRINCETON, IN – Indiana Gov. Mike Braun today highlighted the surge in Indiana’s life sciences sector, with three major industry expansions that will create more than 1,300 new high‑wage Hoosier jobs. These expansions further cement Indiana’s position as a national leader in advanced manufacturing, medical device production, and biopharmaceutical innovation.

Under Gov. Braun’s direction, Indiana’s economic development strategy has focused on two priorities: more jobs for Hoosiers and higher wages. The latest life sciences investments demonstrate the strength of that strategy, and Indiana’s growing dominance in one of the world’s most competitive industries.

INCOG BioPharma: $200M Expansion, Adding Hundreds of New Jobs in Fishers

INCOG BioPharma Services will be doubling its current Indiana workforce to nearly 1,000 employees by 2030. The $200 million expansion of its Fishers manufacturing campus will create hundreds of new high‑paying jobs, with an average wage 159% above the county average and expand the company’s capacity to produce up to 480 million injectable drug units annually. The 21‑acre campus will grow to approximately 300,000 square feet of purpose‑built space, positioning Indiana as a global hub for injectable biopharmaceuticals.

West Pharmaceutical Services: New Greenfield Operation, Up to 300 High‑Wage Jobs

West Pharmaceutical Services Inc. is expanding into Indiana with a new manufacturing operation in Greenfield, creating up to 300 high‑wage jobs that pay an average wage 125% above the county average. The investment strengthens Indiana’s role in the global pharmaceutical and medical device supply chain and underscores the state’s ability to attract world‑class advanced manufacturing employers.

Autocam Medical: 300 New High‑Wage Jobs in Kosciusko County

Autocam Medical is expanding its operations in Warsaw, creating 300 new high‑wage jobs, with average wages 138% above the county average. The expansion reinforces Warsaw’s title as the Orthopedic Capital of the World and showcases the Hoosier state’s unmatched talent pipeline in precision engineering and advanced manufacturing.

Indiana’s life sciences sector is delivering results that matter with repeated wins, record investment, and high‑wage jobs in every corner of the state. With major expansions in Fishers, Greenfield, and Warsaw, Indiana is proving that a strategy centered on jobs and wages works. These projects strengthen the state’s global leadership in biopharmaceuticals and medical device manufacturing while creating long‑term, high‑value opportunities for Hoosier workers and families.