As law enforcement arrested five people last week in connection with the shooting of a Tippecanoe County trial court judge, the Indiana Senate moved forward with a bill that would increase security for the state’s appellate court judges.

Senate Bill 291, authored by Sen. Scott Baldwin, R-Noblesville, would establish a specialized court security unit for the Indiana Supreme Court, the Court of Appeals of Indiana and the Indiana Tax Court. These court marshals would attend court proceedings, provide security at events, such as judicial conferences and community outreach programs, and maintain a security system at the Statehouse, in judicial staff offices, and at the homes of the justices and judges.

Presenting the bill to the Senate Judiciary Committee on Jan. 14, Baldwin said the court marshals “would ensure Indiana’s judges can carry out their constitutional responsibilities without fear, intimidation or disruption.”

On Thursday, the Senate amended SB 291 to protect the personal information of judges and their families from being disclosed to the public. Judges in the state and federal district courts in Indiana would be covered, along with their spouses and children who reside in the same household. The personal information that would be private includes home addresses, phone numbers, email addresses, license plate numbers or other unique identifiers of a vehicle, Social Security numbers, birth or marital records, and election and campaign finance reports.

Also, the amendment makes the unlawful publication of the personal information a Class A misdemeanor.

Introducing the amendment on the Senate floor, Baldwin indicated the provision was added in response to the wounding of Tippecanoe County Superior Court Judge Steven Meyer and his wife in a shooting at their home in Lafayette on Jan. 18. The amendment passed on a voice vote.

SB 291 passed its third reading unanimously in the full Senate Monday and now heads to the Indiana House.

Increasing threats toward judiciary

A day after the Senate amended the legislation, Indiana Chief Justice Loretta Rush and Tippecanoe County Circuit Court Judge Sean Persin led a security webinar for state judges. Security expert James Hamilton joined the 30-minute discussion and nearly 200 judges attended virtually.

“An attack on a judge is not just an attack on that judge,” Rush said during the webinar. “It’s really an attack on our free society and the critical role the judiciary plays in securing that.”

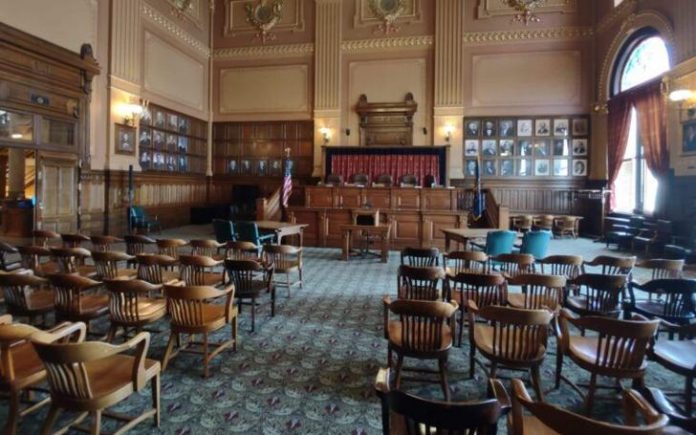

The webinar was broadcast from Judge Meyer’s courtroom in the Lafayette courthouse.

Meyer and his wife, Kim, were shot on the afternoon of Jan. 18 by a man who showed up at their private residence and fired two shotgun blasts through the closed front door, according to reporting by Based in Lafayette. The attack wounded Meyer and his wife.

Based in Lafayette reported that Kim Meyer was treated for a wound to her hip and released Sunday evening. Meyer sustained an injury to his arm and was transported to an Indianapolis hospital for treatment.

“His left arm is badly injured and will require additional surgeries and most likely a long rehab,” Kim Meyer told Based in Lafayette. “It could have been so much worse, though.”

After a manhunt that included Lafayette Police and Indiana State Police, the FBI, U.S. Marshals Service, and law enforcement in Lexington, Kentucky, and Allentown, Pennsylvania, five people have been arrested and charged in connection to the shooting, according to Based in Lafayette. Court documents, cited by Based in Lafayette, linked the attack to an alleged conspiracy involving Thomas Moss, 43, of Lafayette, who is a high-ranking member of the Phantom Motorcycle Club and had been scheduled to go on trial in Meyer’s court on Jan. 20.

Chief Justice Rush has been vocal about growing hostilities in courtrooms and increasing threats toward judges. People appearing in court are using foul language toward the judges, attempting to intimidate them, being disrespectful, and getting into brawls, she said.

A December 2023 survey by the Indiana Supreme Court’s Office of Judicial Administration found that nearly three-quarters of state judges had been the target of a threat. Judges told the survey that litigants had brandished firearms, threatened to set them on fire and blow up their homes.

“Threats to the judiciary, in my time as a judge, are at an all-time high,” Rush said in October when the Indiana Supreme Court released its 2024-25 annual report. “I have judges that hear cases and sentence people with no security in the courtroom. So, it’s just dangerous.”

Bill’s provisions called ‘a minimum effort’

In 2025, Rush had sought from the Indiana General Assembly $1.5 million in additional funding for court security. The chief justice said she envisioned the money being used to create a matching grant program, which the trial courts could tap into to help fund protective measures like metal detectors or security guards.

The funding request was denied.

SB 291 would not require any additional appropriation from the legislature. Court of Appeals Judge Cale Bradford told the Senate Judiciary Committee that the Indiana Supreme Court already has its own security staff, and former Gov. Eric Holcomb had previously obtained funding for a security unit for the appellate court.

However, Bradford said, state statute needs to be updated to expand the security provision to include the Court of Appeals.

“We’re not looking to get any other police department’s business,” Bradford told the committee. “We just want to maintain the security for the people that are with us, meaning the kids at the schools, the public, and our judges and our staff.”

Some members of the Judiciary Committee were taken aback that the appellate courts did not have security. Sen. Jim Buck, R-Kokomo, said he was shocked to find out the judiciary did not have protection, especially since the speaker of the House and the Senate president pro tempore do have that.

Sen. Sue Glick, R-LaGrange, is an attorney and former LaGrange County prosecutor. Before casting her vote in support and asking the author to add her name to the bill, she told the committee she had clerked for the Court of Appeals early in her legal career.

“It surprised me then and it surprises me now that we haven’t taken this step,” Glick said. “Most of these judges comes from the trial court. They’ve left behind them people they’ve sent to jail who may have an ax to grind. This is a minimum effort, I believe, but it is a good first step in protecting them.”